Taxes: Set up Tax for EU-based business

If you're running EU-registered business there are some strict tax rules to follow. HostBill gives you the tool to make the EU tax configuration quick and simple.

Set your tax rules

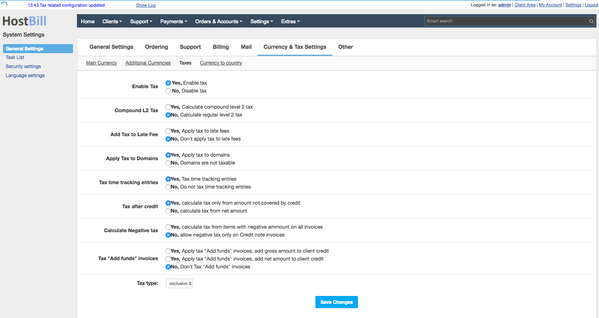

In Settings → Tax Settings configure general tax settings to match image below:

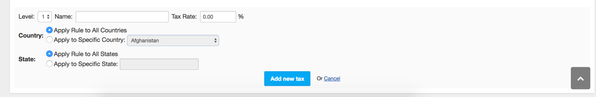

Next, add tax rate for each EU-Member country. To do so in Settings → Tax settings use option "Add new tax" (note: set up your country VAT rate for each country).

The fastest way to add all rules for your country and EU-Member countries is to use option "Add premade tax list" as shown on screenshot below.

After clicking on "Add premade tax list" select your country from drop-down list and accept.

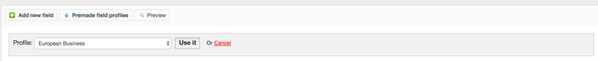

Add field to collect VAT Id

Go to Clients → Registration Fields and from "Premade field profiles" select "European Business" profile. This will automatically add VAT-EU field. You can also manually add VAT-EU to your registration fields, just make sure that this field applies to Company and set variable name in Advanced tab to vateu