Taxes

You can find this section in HostBill Admin → Settings → General Settings → Taxes

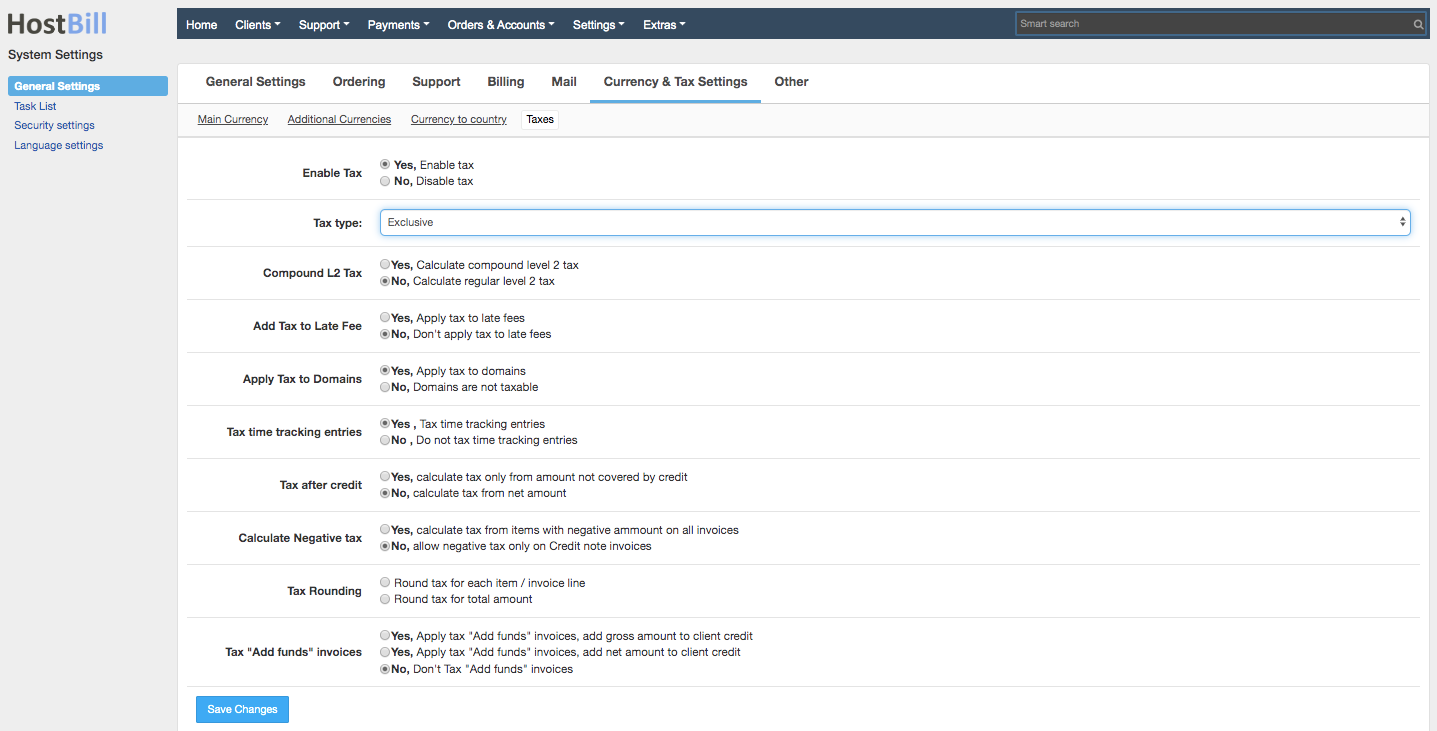

Tax settings

Enable Tax

This option controls whether or not tax is calculated, you need to enable this to see other tax options.

Tax type:

This option changes how prices are calculated.

- Exclusive - prices that you set in system are net prices, customer will see on the invoice net price + tax calculated from this price.

- Inclusive - prices that you set in system are gross prices, net values and included tax will be automatically calculated.

Compound L2 Tax

Controls whether or not you want to compound and collect a level 2 tax or not. Tax level 2 may be required in some countries (for example in Canada) and needs to be described separately on the invoice. Regular level 2 tax is calculated from the net amount. Compound level 2 tax is calculated from the amount excluding tax level 1.

Add Tax to Late Fee

Adds additional taxes for late invoices, thus applying taxes to the late fee balance.

Apply Tax to Domains

If enabled, domain registrations, transfers and renewal will be taxed.

Tax time tracking entries

Controls whether tax is calculated for time tracking entries. Time tracking entries are used for billing tickets - you can learn more in Ticket Billing article.

Tax after credit

Controls whether tax is calculated before or after credit is applied.

Calculate Negative tax

Controls whether tax should be calculated for items with negative amount on all invoices or only credit note invoices.

Tax rounding

With this option you can choose to round tax for each item / invoice line or round tax for total amount

Tax "Add funds" invoices

If enabled, tax will be added to invoices generated with "Add funds" feature.

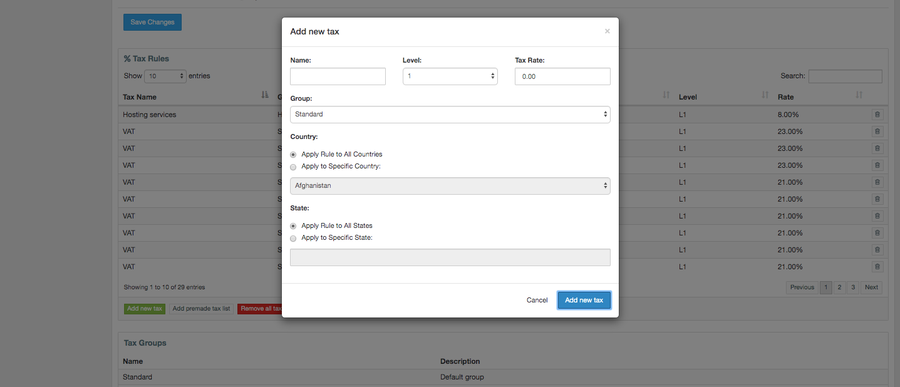

Setting up new taxes

This option allows you to define taxes that will be applied to your client invoices. Click on 'Add new tax" button and configure your tax rules:

- Name - name of the tax displayed in client area

- Level - select between level 1 and 2

- Tax Rate - percentage tax rate

- Group - assign tax to a certain tax group

- Country - you can select to apply this tax to all your customers or only those from selected country

- State - you can select to apply this tax to all your customers or only those from selected state

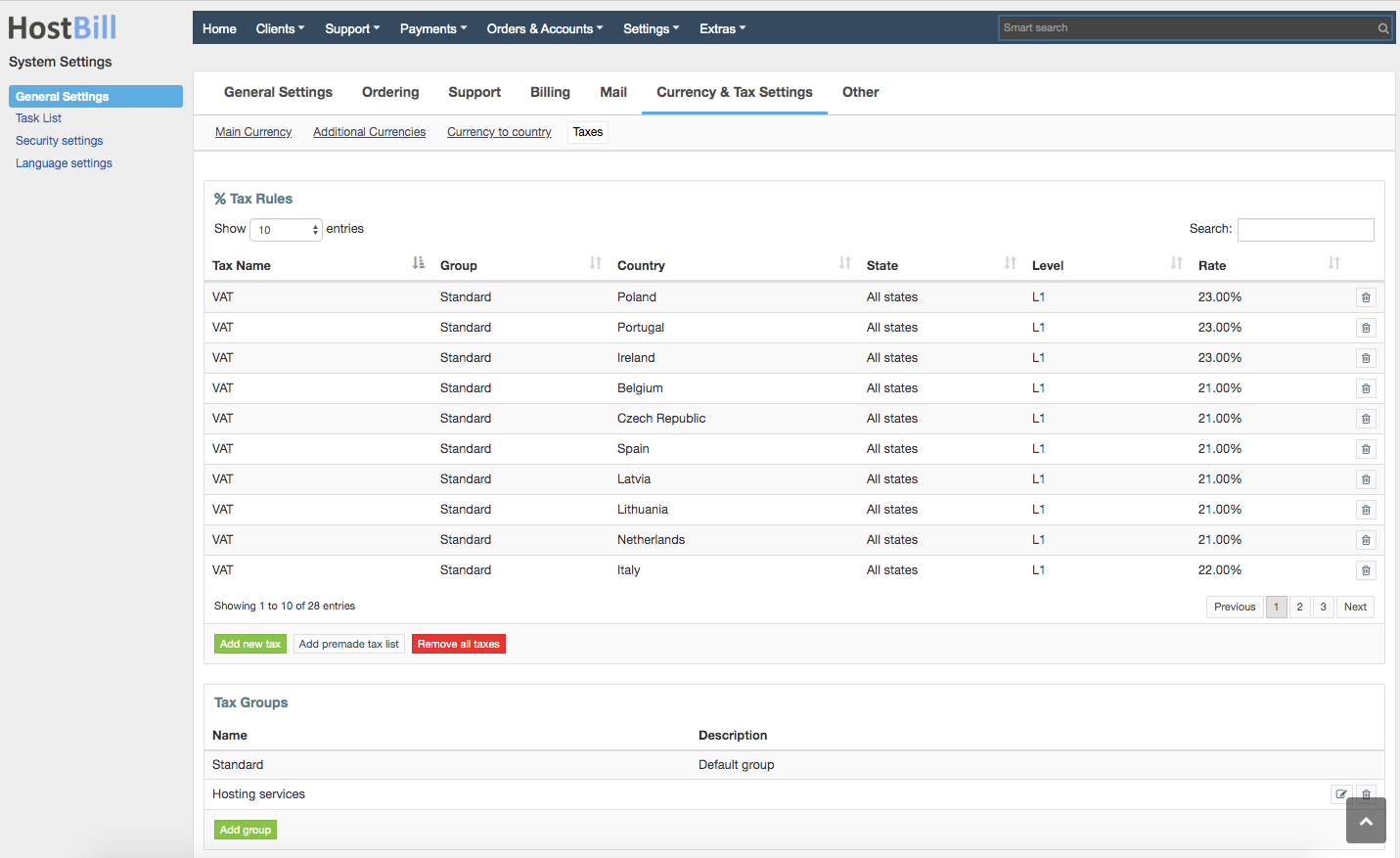

Use your country pre made tax settings

You can quickly set-up your tax configuration by using one of our presets. Simply choose the country from the drop-down list.

Tax groups

You can create multiple tax groups (by default there is one, standard tax group), with different tax levels and assign them to different products.

To create a new tax group click on green 'Add group' button, enter the name and description for the group. Once you create a group you can add and configure a new tax and assign it to the given group. This is especially useful to EU businesses, where there are different tax rates for different products, depending on product/service category etc.