Overview

...

The VIES VAT EU plugin is a must-have for every EU business as it's an extremly helpful tool that will allow you to check whether VAT number provided by the customer is valid based on European Commision tool VIES. If the number is valid the plugin can automatically switch-on tax exception for the customer and apply reverse-charge note to related invoices. Invalid VAT-id entries will be automatically removed and all VAT field or tax-except changes will be logged, enabling you to prevent customers from your country from getting tax-exception. Thanks to this module you can also auto-set local tax rate for B2C customers (required by MOSS).

With this module:

- Your country company/private entities will be charged your local VAT, with Tax rate of your country as set in Tax configuration

- Any EU citizen which has no VAT number, will be charged VAT, with Tax rate of their country, as in MOSS procedure

- EU company with valid VAT number would not be charged any tax

- Clients outside EU would not be charged any tax

Activating the module

...

- If the plugin is included in your HostBill edition you can download it from your client portal.

- If the plugin is not included in your HostBill edition you can purchase it from our marketplace and then download it from the client area.

- Once you download the plugin extract it in the main HostBill directory.

- Go to Settings → Modules, find and activate Vies VAT EUplugin.

- Once the plugin is activated you will be directed to Settings→ Modules→ Plugins to configure the plugin.

...

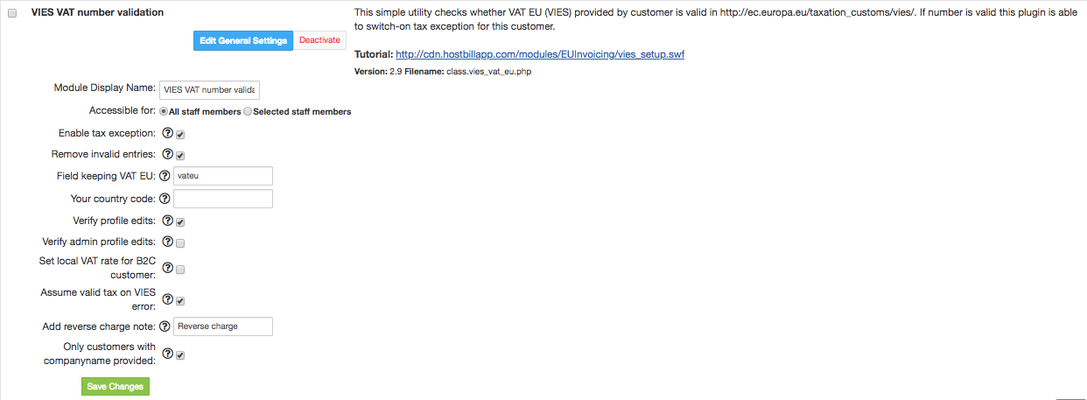

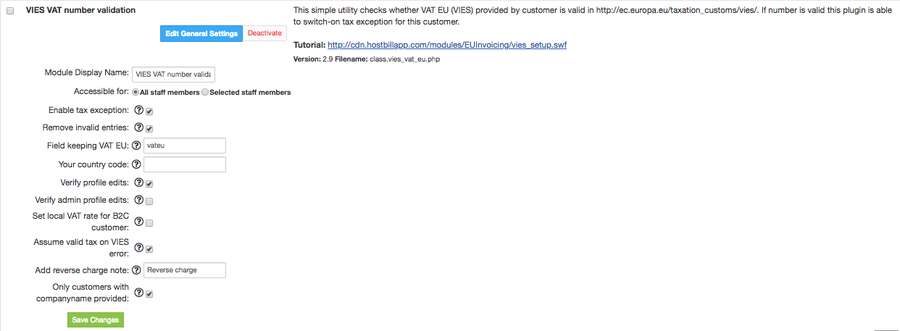

- Tick if you want to Enable tax exeption - it determines whether customers with valid VAT EU that are not from your country should get VAT Exemption.Default: ON

- Tick if you want to Remove invalid entries - it determines, whether invalid VAT EU number entered should be auto-removed from. Default: ON

- Field keeping VAT EU - enter field code from Clients→Registration fields that is responsible for keeping customer VAT EU number.

- Your country code - enter ISO code of your country. This value is used to determine whether customers should be charged your local VAT.

- Tick if you want to Verify profile edits - if enabled, VAT EU entry will be verified on customer profile edit Default: ON

- Tick if you want to Verify admin profile edits - if enabled, VAT EU entry will be verified on admin profile edit Default: ON.

- Set local VAT rate for B2C customer - this is useful when using MOSS procedure for taxation. When enabled customer that is from EU, but does not have company with registered VAT EU, will be charged their local VAT rate. Default: ON

- Assume valid tax on VIES error

- Add reverse charge note - enter a text that should be auto-added to invoices for all customers falling under Tax Exception rule (Valid VAT EU, registered outside your country).

- Only customers with company name provided - this option is additional check preventing customers without company name provided using VAT EU field to get tax exception Default: ON.

You can watch the video below for additional help with configuring the module:

| Note | ||

|---|---|---|

| ||

Since version 1.7 VIES VAT EU Plugin is Commercial Extension |

...