...

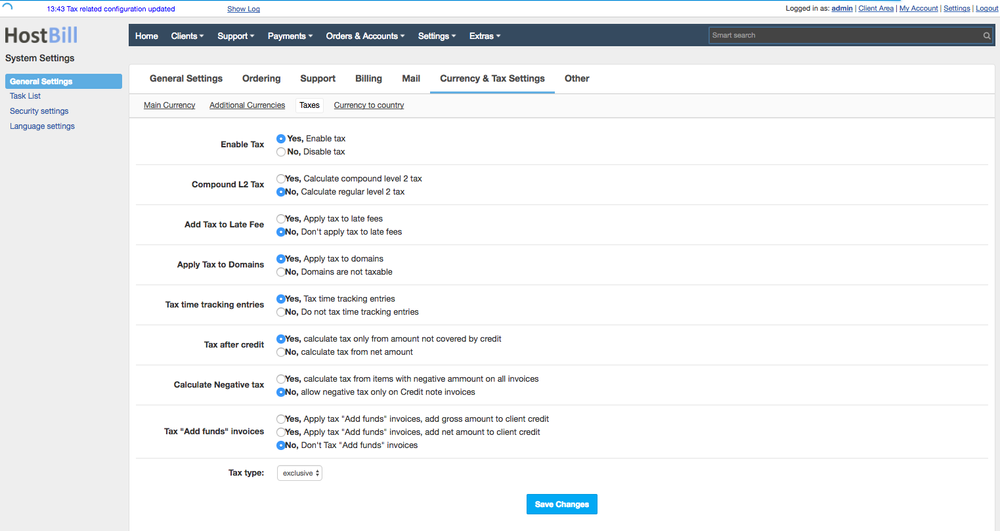

Go to Settings->Tax Settings and configure general tax config to match image below:

Next you need to add tax rate for each EU-Member country, to do so in Settings->Tax settings use option "Add new tax" (note: set up your country vat rate for each country).

...

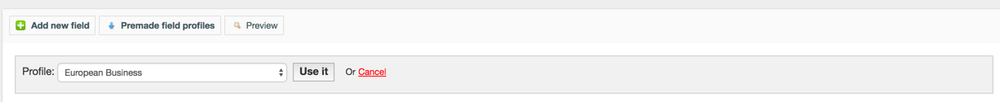

Go to Clients->Registration Fields and from "Premade field profiles" select "European Business" profile. This will automatically add VAT-EU field. You can also manually add VAT-EU to your registration fields, just make sure that this field applies to Company and set variable name in Advanced tab to vateu

Set up VIES VAT number validation plugin

Go to Extras->Plugins->Inactive and activate "VIES VAT number validation".

Set field variable name used in Clients->Registration Fields (vateu in most cases).

Enter your country iso code (use GB instead of UK if you're located in Great Britain).

Available configuration:

- Enable tax exception - Determines whether customers with valid VAT EU that are not from your country should get VAT Exemption. Default: ON

- Remove invalid entries - Determines, whether invalid VAT EU number entered should be auto-removed from. Default: ON

- Field keeping VAT EU - enter field code from Clients→Registration fields that is responsible for keeping customer VAT EU number.

- Your country code - enter ISO code of your country. This value is used to determine whether customers should be charged your local VAT.

- Verify profile edits - If enabled, VAT EU entry will be verified on customer profile edit Default: ON

- Verify admin profile edits - If enabled, VAT EU entry will be verified on admin profile edit Default: ON

- Set local VAT rate for B2C customer - This is usefull when using MOSS procedure for taxation. When enabled customer that is from EU, but does not have company with registered VAT EU, will be charged his local VAT rate. Default: ON

- Add reverse charge note: Enter a text that should be auto-added to invoices for all customers falling under Tax Exception rule (Valid VAT EU, registered outside your country)

- Only Customers with companyname provided: This option is additional check preventing customers without company name provided using VAT EU field to get tax exception Default: ON

How it works?

...