If you're running EU-registered business there are some strict tax rules to follow, but with HostBill its easy to fulfill them. HostBill gives you the tool to make the EU tax configuration quick and simple.

Set your tax rules

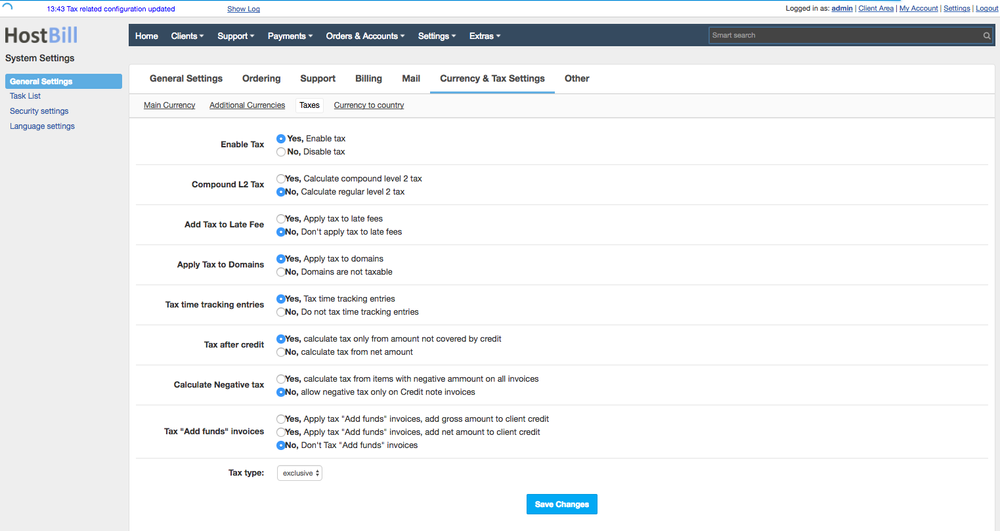

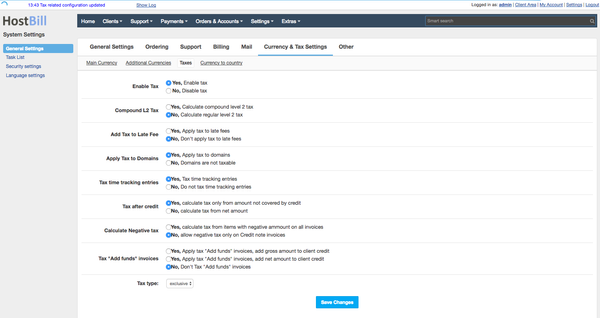

Go to Settings->Tax Settings and In Settings → Tax Settings configure general tax config settings to match image below:

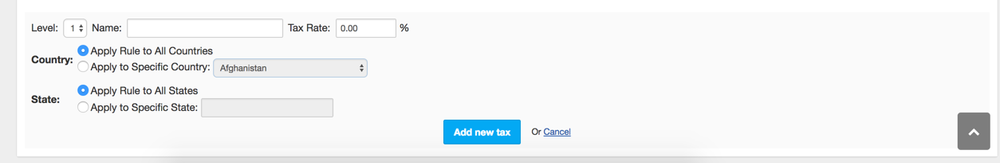

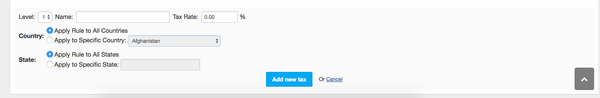

Next you need to , add tax rate for each EU-Member country, to . To do so in Settings ->Tax → Tax settings use option "Add new tax" (note: set up your country vat VAT rate for each country).

Fastest The fastest way to add all rules for your country and EU-Member countries is to use option "Add premade tax list" as shown on screenshot below.

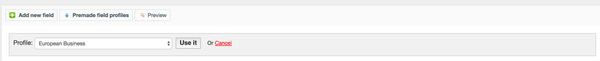

After clicking on "Add premade tax list" select your country from drop-down list and accept.

Add field to collect VAT Id

Go to Clients ->Registration → Registration Fields and from "Premade field profiles" select "European Business" profile. This will automatically add VAT-EU field. You can also manually add VAT-EU to your registration fields, just make sure that this field applies to Company and set variable name in Advanced tab to vateu