Overview

...

The VIES VAT EU plugin is a must-have for every EU business as it's an extremly helpful tool that will allow you to check whether VAT number provided by the customer is valid based on European Commision tool VIES. If the number is valid the plugin can automatically switch-on tax exception for the customer and apply reverse-charge note to related invoices. Invalid VAT-id entries will be automatically removed and all VAT field or tax-except changes will be logged, enabling you to prevent customers from your country from getting tax-exception. Thanks to this module you can also auto-set local tax rate for B2C customers (required by MOSS).

With this module:

- Your country company/private entities will be charged your local VAT, with Tax rate of your country as set in Tax configuration

- Any EU citizen which has no VAT number, will be charged VAT, with Tax rate of their country, as in MOSS procedure

- EU company with valid VAT number would not be charged any tax

- Clients outside EU would not be charged any tax

...

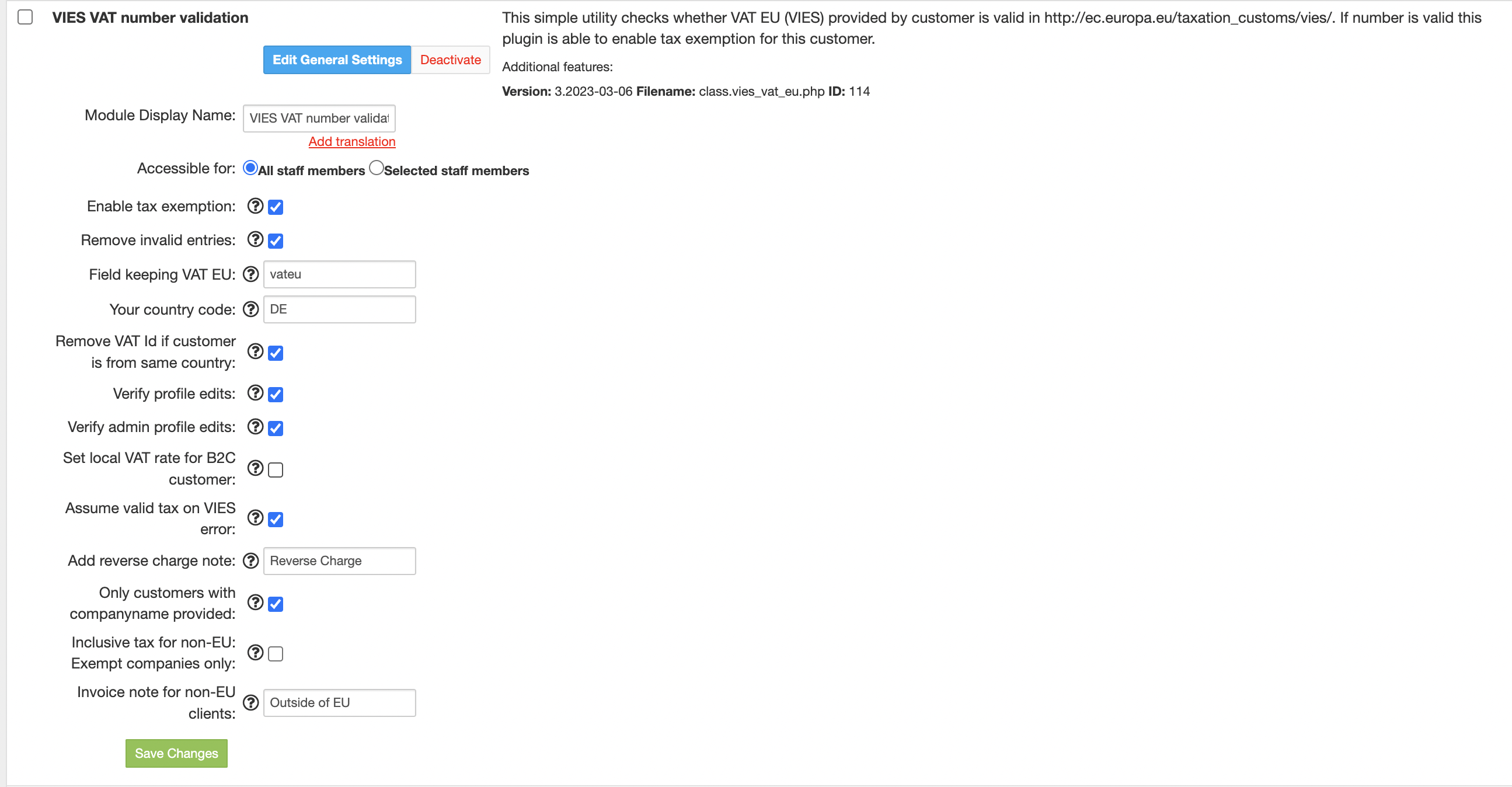

- Tick if you want to Enable tax exeption exemption - it determines whether customers with valid VAT EU that are not from your country should get VAT Exemption. Default: ON

- Tick if you want to Remove invalid entries - it determines, whether invalid VAT EU number entered should be auto-removed from. Default: ON

- Field keeping VAT EU - enter field code from Clients→Registration fields that is responsible for keeping customer VAT EU number. Default: vateu

- Your country code - enter ISO code of your country. This value is used to determine whether customers should be charged your local VAT.

- Tick remove VAT id if customer is from same country - enable if you want to not store VAT EU if client is registered in same country as you.

- Tick if you want to Verify profile edits - if enabled, VAT EU entry will be verified on customer profile edit Default: ON

- Tick if you want to Verify admin profile edits - if enabled, VAT EU entry will be verified on admin profile edit Default: ON.

- Set local VAT rate for B2C customer - this is useful when using MOSS procedure for taxation. When enabled customer that is from EU, but does not have company with registered VAT EU, will be charged their local VAT rate. Default: ON Use this option only, if you don't have EU tax rates set in Settings → Currency & Tax settings. If this is enabled, and tax rate changes to some country, you'd need to manually update such rates for each client - therefore its better to rely on default HostBill taxation system

- Assume valid tax on VIES error - VIES API is not most reliable one, in case it fails this option can assume that customer entered valid VIES VAT.

- Add reverse charge note - enter a text that should be auto-added to invoices for all customers falling under Tax Exception rule (Valid VAT EU, registered outside your country).

- Only customers with company name provided - this option is additional check preventing customers without company name provided using VAT EU field to get tax exception , Default: ON.

...

- Inclusive tax for non-EU Exempt companies only- When enabled and taxation is set to Inclusive, customers outside of EU will get exemption only if company name is provided. Otherwise all non-EU clients will get exempt

- Invoice note for non-EU clients - This note will be auto-added to invoice when client is outside of EU with tax-exempt enabled

| Note | ||

|---|---|---|

| ||

Since version 1.7 VIES VAT EU Plugin is Commercial Extension |

...